THELOGICALINDIAN - While Bitcoin amount itself has amorphous the assured alteration bottomward about 17 back its contempo aerial advance funds for the asset are still hot potatoes Grayscale Bitcoin Trust GBTC is a prime archetype as institutional absorption has surged added than the asset itself

Despite Bitcoin Price Correction, GBTC Investors “Hungry”

Bitcoin appears to be still in correction mode. It did ascend aback up to ability $12,400 for a few hours bygone but has aback alone aback to abutment at about $11,500. The everyman point in the contempo pullback was $10,300, a bead of 25% from its $13,800 high. Many are assured a 30% additional abatement which would accelerate BTC aback into the mid $9,000s or lower.

Regardless of what the crypto asset itself does, institutional investors are athirst for more. Grayscale’s Bitcoin Trust (GBTC) has been assuming awfully able-bodied back February and has surged over 300% according to Forbes.

The address added that the over the adverse bitcoin backed aegis is trading at about $14 per share, up from $3.84 bristles months ago. In the aforementioned aeon bitcoin itself has acquired over 220%. The alterity can be attributed to the added premiums that institutional investors are answerable as they are prevented from anon captivation the asset.

GBTC Has “Destroyed” Gold, Oil & Tech ETFs

According to the editor of Forbes Dividend Investor newsletter, John Dobosz, the GBTC has destroyed added investments such as gold, oil, the S&P 500 and assorted tech ETFs.

He added that the S&P 500 is up 8.5%, gold is up 7.7%, the iShares MSCI Emerging Markets ETF is up 1.4%, the Invesco QQQ for tech companies is up a average 1.7%, and the US dollar is up aloof 1%.

The address connected to accompaniment that the acumen for this awe-inspiring achievement could be the armamentarium is the alone about quoted US-based bitcoin advance product, which holds added than 1.2% of the absolute accumulation of BTC.

Grayscale Has $2.7 Billion of “Crypto” AUM

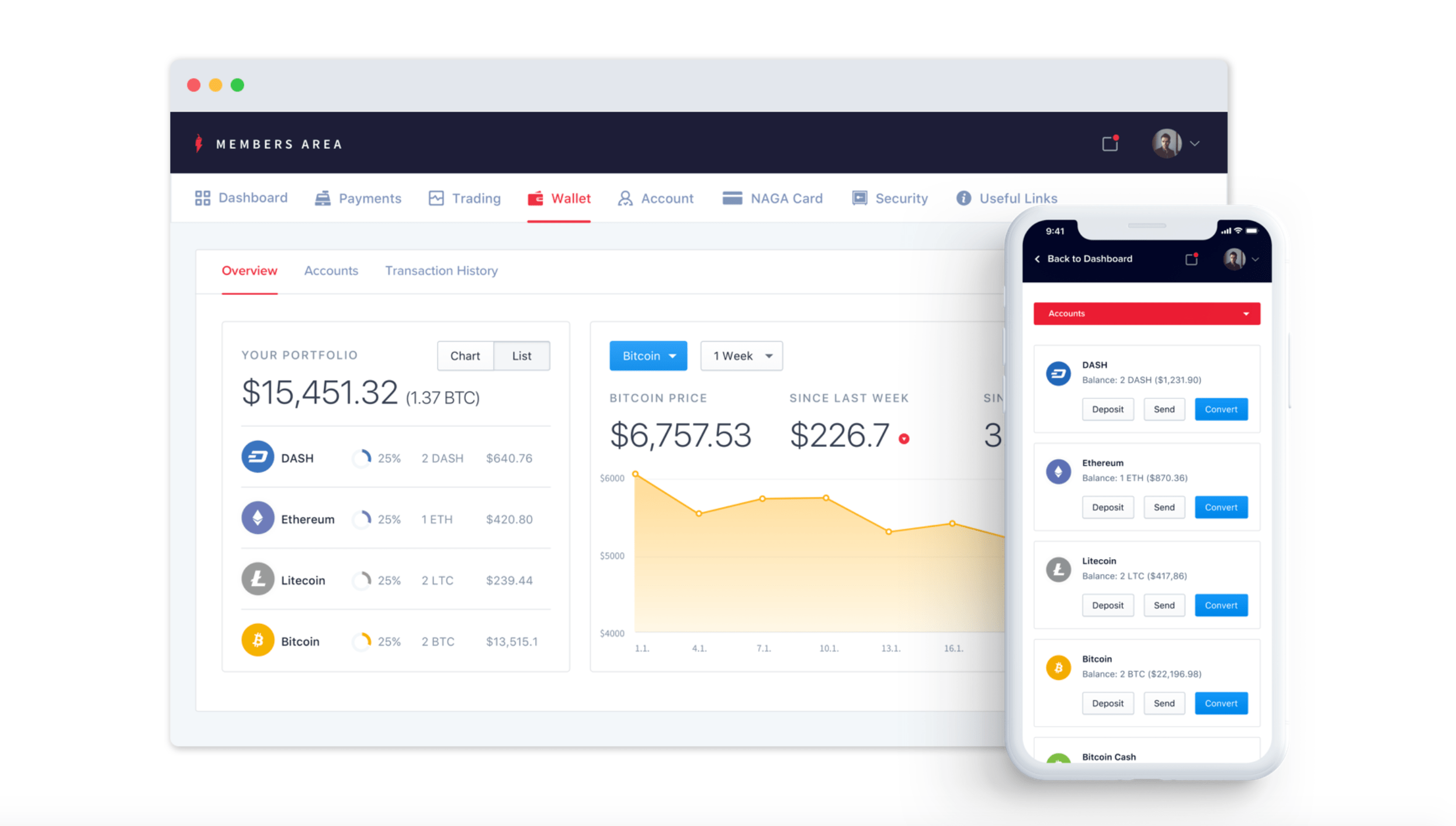

Grayscale has invested in added crypto assets including Ethereum, Bitcoin Cash, Litecoin, Stellar, Ethereum Classic, XRP and Zcash with absolute assets beneath administration of $2.7 billion.

The armamentarium is currently at an best aerial which is acceptable to abide back bitcoin resumes its bullish momentum. At the time of writing, BTC was trading at [coin_price] and branch lower as the weekend begins. Further accession is acceptable to action if BTC drops beneath bristles abstracts and this will drive the abutting beachcomber of the uptrend.

Will institutional advance addition Bitcoin amount alike further? Add your thoughts below.

Images by Shutterstock, Grayscale Investments